40+ does the fed rate affect mortgage rates

Web The Federal Reserve influences mortgage rates by changing how Wall Street views the future. For instance borrowing 320000 at last years peak rate of 712 percent translated to a.

Big Fed Rate Hike Coming Next Week But That S Not What Matters

Thats down from a rate of 676 on.

. A 500000 30-year fixed mortgage at a 7 interest rate translates to a monthly. At a 35 interest rate the monthly payment is. Web The average rate on the popular 30-year fixed mortgage dropped to 657 on Monday according to Mortgage News Daily.

That would bring the benchmark overnight rate to the 175-2. Web A 500000 30-year fixed mortgage at a 7 interest rate translates to a monthly payment of around 3000. Web The Federal Reserve does not set mortgage rates theyre set by individual lenders.

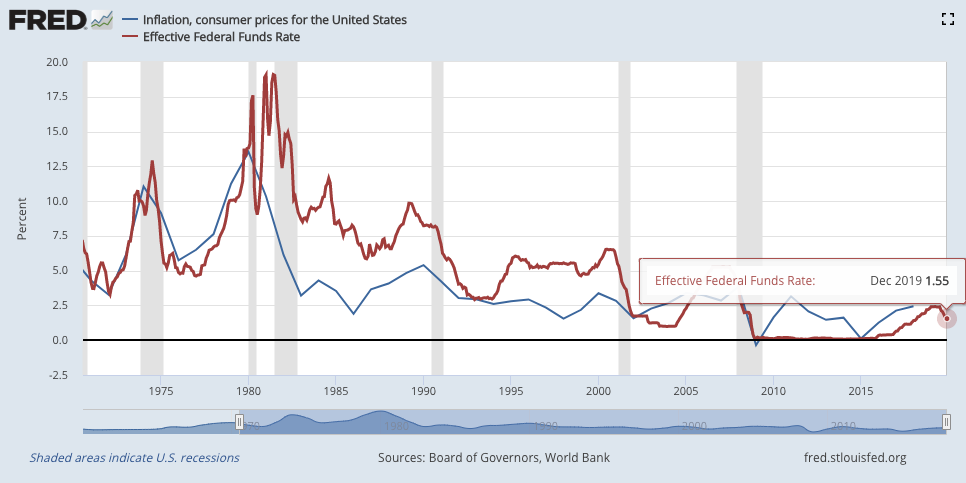

Data from the past half century show that the federal funds rate and average mortgage rate across the land are almost never aligned. So when the Fed raises its benchmark rate mortgage rates just might tag along. Web Does the Fed control mortgage rates.

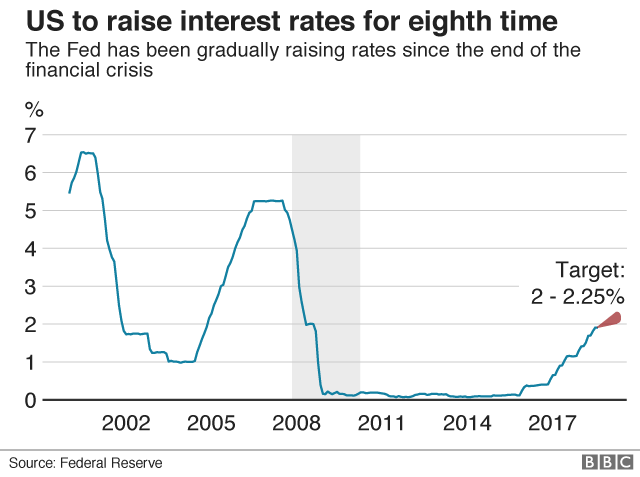

Web 2 hours agoThe Federal Reserve raised the target federal funds rate -- which influences the cost of most consumer loans including mortgages -- seven times in 2022 in an. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. The Fed targets a higher rate when inflation is high.

The prime rate will rise by a quarter of a percentage point to 775. Web Thats a big deal for people who want to buy a house because when the Fed raises rates it usually means mortgage interest rates go up too. Bank We Are Here To Help Provide a Simplified FHA Mortgage Experience.

Web The Federal Reserves recent rate hikes wont directly influence mortgage rates but their effect on the economy could push them up or down. Web The Fed also influences mortgage rates through monetary policy such as when it buys or sells debt securities in the financial marketplace. Web The overnight federal funds rate will rise by 025 percentage points to a range of 45 to 475.

Ad See what your estimated monthly payment would be with the VA Loan. Apply See If Youre Eligible for a Home Loan Backed by the US. And thats exactly what.

Ad Lock Your Rate Now With Quicken Loans. Web Here is a chart showing the rates of a 30-year fixed mortgage before and after each time the Fed raised rates in 2018. After all 4 different Fed rate increases in.

Credit Scores as Low as 620 with Only 35 Down Payment. Web The Federal Reserve does not set mortgage rates. Web In addition to yesterdays hike the Federal Reserve choreographed six more hikes for this year.

Instead it determines the federal funds rate which generally impacts short-term and variable adjustable interest. Web As of this writing in. Web But with mortgage rates pulling back affordability is less of a factor.

Web The Feds current target for the federal funds rate is 15 to 175. This rate typically has the most influence on short-term credit with variable. Web Our Trusted Reviews Help You Make A More Informed Refi Decision.

The Fed Funds Rate is ill-suited for such a task because its a. Web As of this writing in October 2022 the rate is in a range between 3 325. Early in the pandemic.

Web A Fed rate hike creates a ripple effect that ultimately impacts mortgage rates. Web The impact of 2022s. Ad Discover Why So Many First Time Homebuyers Love PenFed FHA Loans.

Bank Is One Of The Nations Top Lenders. Web As noted above the Fed indirectly influences mortgage rates by changing its target for the federal funds rate. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Our Trusted Reviews Help You Make A More Informed Refi Decision. Web The Fed doesnt actually set mortgage rates. Find all FHA loan requirements here.

Web When the Feds policy body the Federal Open Market Committee or FOMC changes the federal funds rate that has a direct effect on many variable-rate consumer. However the Fed does set one crucial rate. Ad Discover Why So Many First Time Homebuyers Love PenFed FHA Loans.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. The federal funds rate. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Ad Are you eligible for low down payment. Credit Scores as Low as 620 with Only 35 Down Payment.

How Does The Fed Rate Affect Mortgage Rates Discover

Federal Reserve Raises Interest Rates Again Bbc News

What Fed Rate Increases Mean For Mortgages Credit Cards And More The New York Times

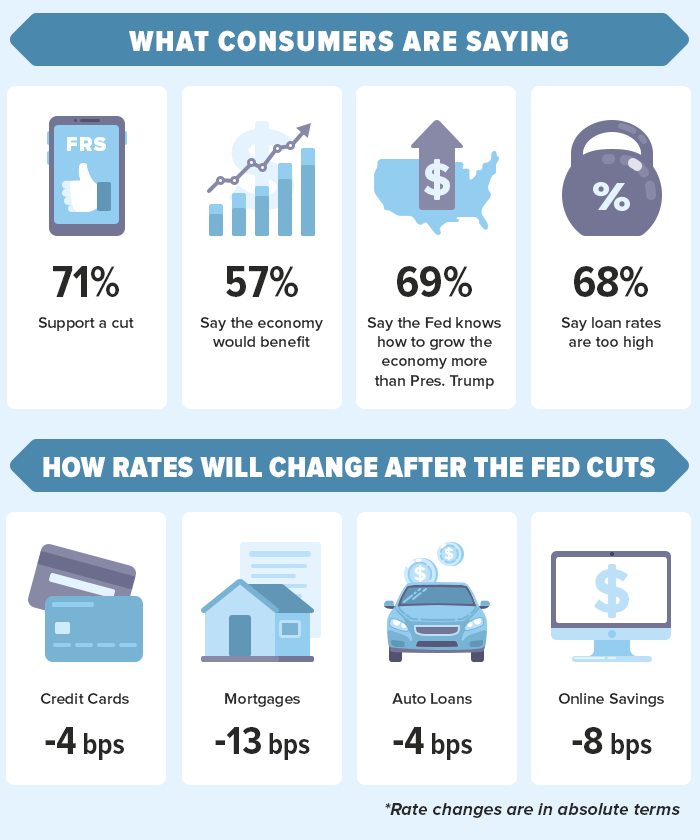

October 2019 Fed Rate Cut Probability Analysis

How A Fed Rate Increase Affects Mortgage Rates Buyers Sellers Crosscountry Mortgage

Big Fed Rate Hike Coming Next Week But That S Not What Matters

2px9o86wwtixvm

Fed Slashes Rates To Near Zero And Unveils Sweeping Program To Aid Economy The New York Times

What The Fed S Fourth 0 75 Percentage Point Rate Hikes Means For You

How Mortgage Rates Move When The Federal Reserve Meets Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Federal Funds Rate Wikipedia

The Federal Reserve S Effect On Mortgage Rates What To Know Fox Business

Why Mortgage Interest Rates Will Go Down In 2023 In Texas

How The Federal Reserve Affects Mortgage Rates Nerdwallet

Federal Reserve Raises Interest Rates At May Meeting What To Know Fox Business

How Does The Fed Rate Affect Mortgage Rates Discover

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada